Capital One CreditWise is a great option if you are in search of a free credit monitoring system. It's a simple tool that allows you free credit monitoring. You'll be disappointed to learn that it doesn't have some of the most important features, and is very easy to cancel.

Free credit monitoring tool

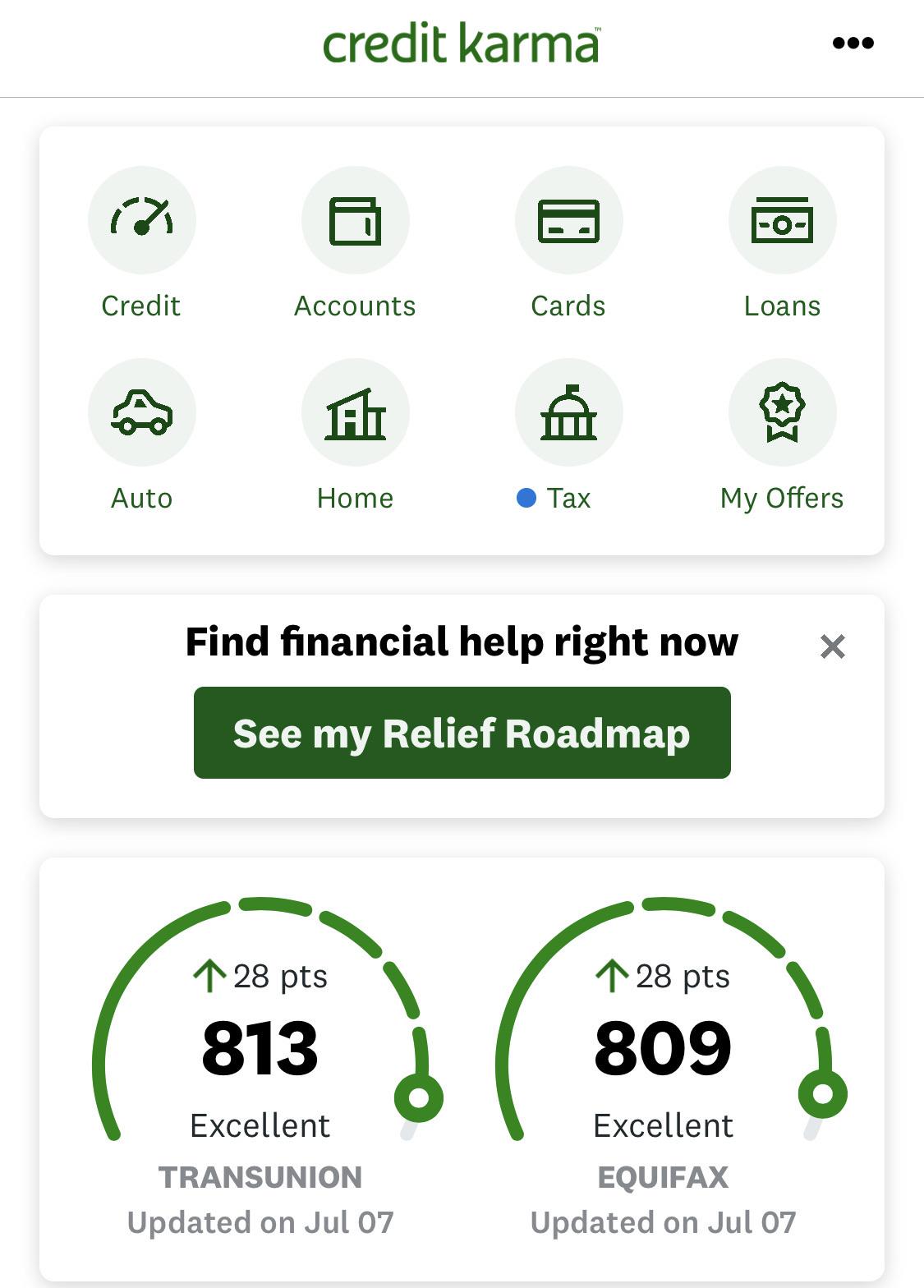

Capital One CreditWise allows you to monitor your credit score and sends alerts if anything changes. You'll be notified by it if your credit score changes. It uses TransUnion's VantageScore 3.0 scoring system, which evaluates credit using the same criteria as the FICO Score. It sends you your credit score each week.

Capital One credit card holders can sign up for CreditWise, which is completely free. The only thing you need to do is provide your Social Security Number. To confirm your identity, the site will ask you some questions.

Easy to use

CreditWise from Capital One is a tool that lets you monitor your credit. It allows you to track your credit score and detect errors in your credit reports. The tool can be used online and on your mobile phone. You can also get tips for improving your credit score.

CreditWise from Capital One also provides you with updates on your credit report, including new account inquiries and delinquent accounts. This free service can help improve your financial decisions, such as when applying to finance. However, it is important to realize that your credit score is just one part of your overall financial picture.

Lacks certain features

Capital One credit wise is a free service that helps you monitor your credit. This service allows you to check your credit report and check your credit score. While it has many positive aspects, there are also some flaws. You can get it free of charge with your Capital One credit cards.

Although it lacks certain features like chat functionality or secure messaging, the app offers a solid collection of tools. You can use the app for managing your Capital One account as well as tracking your credit score. The app is available for both Android and iOS, and has an intuitive user interface. It also has excellent security features.

It is simple to cancel

There are a few things you can do if Capital One cancels your credit wise subscription. Go to CreditWise's website and choose "Settings". After this, click on "Cancel subscription." Or, you can call Capital One at 03444 810 882. You can cancel your subscription by SMS using the Next Generation Text (NGT).

Capital One's credit wise service has another advantage: it is completely free. It can be found on Google Play and in the Apple App Store. The app offers the same features and information as the website but is available in a mobile version. This is an excellent way to keep track your financial status without opening a web browser.

FAQ

What kinds of investments exist?

There are many investment options available today.

Some of the most popular ones include:

-

Stocks - A company's shares that are traded publicly on a stock market.

-

Bonds – A loan between two people secured against the borrower’s future earnings.

-

Real estate - Property that is not owned by the owner.

-

Options - Contracts give the buyer the right but not the obligation to purchase shares at a fixed price within a specified period.

-

Commodities - Raw materials such as oil, gold, silver, etc.

-

Precious metals – Gold, silver, palladium, and platinum.

-

Foreign currencies – Currencies not included in the U.S. dollar

-

Cash – Money that is put in banks.

-

Treasury bills - The government issues short-term debt.

-

Commercial paper is a form of debt that businesses issue.

-

Mortgages - Individual loans made by financial institutions.

-

Mutual Funds – Investment vehicles that pool money from investors to distribute it among different securities.

-

ETFs: Exchange-traded fund - These funds are similar to mutual money, but ETFs don’t have sales commissions.

-

Index funds - An investment vehicle that tracks the performance in a specific market sector or group.

-

Leverage – The use of borrowed funds to increase returns

-

ETFs - These mutual funds trade on exchanges like any other security.

These funds offer diversification benefits which is the best part.

Diversification is when you invest in multiple types of assets instead of one type of asset.

This helps to protect you from losing an investment.

Do I need to invest in real estate?

Real Estate Investments can help you generate passive income. However, they require a lot of upfront capital.

Real estate may not be the right choice if you want fast returns.

Instead, consider putting your money into dividend-paying stocks. These stocks pay out monthly dividends that can be reinvested to increase your earnings.

How can I get started investing and growing my wealth?

Learning how to invest wisely is the best place to start. This way, you'll avoid losing all your hard-earned savings.

Also, you can learn how grow your own food. It's not as difficult as it may seem. You can easily plant enough vegetables for you and your family with the right tools.

You don't need much space either. Just make sure that you have plenty of sunlight. Plant flowers around your home. They are easy to maintain and add beauty to any house.

Consider buying used items over brand-new items if you're looking for savings. They are often cheaper and last longer than new goods.

What investments are best for beginners?

Beginner investors should start by investing in themselves. They should also learn how to effectively manage money. Learn how you can save for retirement. Budgeting is easy. Learn how you can research stocks. Learn how you can read financial statements. Avoid scams. Learn how to make sound decisions. Learn how to diversify. Learn how to guard against inflation. Learn how to live within their means. How to make wise investments. You can have fun doing this. It will amaze you at the things you can do when you have control over your finances.

What are the four types of investments?

The main four types of investment include equity, cash and real estate.

The obligation to pay back the debt at a later date is called debt. This is often used to finance large projects like factories and houses. Equity can be defined as the purchase of shares in a business. Real estate is when you own land and buildings. Cash is what you have on hand right now.

When you invest in stocks, bonds, mutual funds, or other securities, you become part owner of the business. You are part of the profits and losses.

Does it really make sense to invest in gold?

Since ancient times, gold is a common metal. It has remained a stable currency throughout history.

Gold prices are subject to fluctuation, just like any other commodity. A profit is when the gold price goes up. A loss will occur if the price goes down.

No matter whether you decide to buy gold or not, timing is everything.

How can I invest wisely?

You should always have an investment plan. It is important to know what you are investing for and how much money you need to make back on your investments.

You need to be aware of the risks and the time frame in which you plan to achieve these goals.

This will help you determine if you are a good candidate for the investment.

Once you have chosen an investment strategy, it is important to follow it.

It is best not to invest more than you can afford.

Statistics

- They charge a small fee for portfolio management, generally around 0.25% of your account balance. (nerdwallet.com)

- If your stock drops 10% below its purchase price, you have the opportunity to sell that stock to someone else and still retain 90% of your risk capital. (investopedia.com)

- 0.25% management fee $0 $500 Free career counseling plus loan discounts with a qualifying deposit Up to 1 year of free management with a qualifying deposit Get a $50 customer bonus when you fund your first taxable Investment Account (nerdwallet.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

External Links

How To

How to invest stocks

Investing is one of the most popular ways to make money. It is also considered one the best ways of making passive income. There are many options available if you have the capital to start investing. There are many opportunities available. All you have to do is look where the best places to start looking and then follow those directions. This article will guide you on how to invest in stock markets.

Stocks can be described as shares in the ownership of companies. There are two types: common stocks and preferred stock. Public trading of common stocks is permitted, but preferred stocks must be held privately. Stock exchanges trade shares of public companies. The company's future prospects, earnings, and assets are the key factors in determining their price. Stocks are bought to make a profit. This process is known as speculation.

Three main steps are involved in stock buying. First, you must decide whether to invest in individual stocks or mutual fund shares. The second step is to choose the right type of investment vehicle. Third, determine how much money should be invested.

Choose whether to buy individual stock or mutual funds

For those just starting out, mutual funds are a good option. These mutual funds are professionally managed portfolios that include several stocks. When choosing mutual funds, consider the amount of risk you are willing to take when investing your money. Some mutual funds have higher risks than others. If you are new to investments, you might want to keep your money in low-risk funds until you become familiar with the markets.

You should do your research about the companies you wish to invest in, if you prefer to do so individually. Before buying any stock, check if the price has increased recently. You don't want to purchase stock at a lower rate only to find it rising later.

Choose Your Investment Vehicle

Once you've made your decision on whether you want mutual funds or individual stocks, you'll need an investment vehicle. An investment vehicle is simply another way to manage your money. For example, you could put your money into a bank account and pay monthly interest. You can also set up a brokerage account so that you can sell individual stocks.

Self-directed IRAs (Individual Retirement accounts) are also possible. This allows you to directly invest in stocks. You can also contribute as much or less than you would with a 401(k).

Your investment needs will dictate the best choice. Are you looking for diversification or a specific stock? Are you looking for growth potential or stability? Are you comfortable managing your finances?

The IRS requires all investors to have access the information they need about their accounts. To learn more about this requirement, visit www.irs.gov/investor/pubs/instructionsforindividualinvestors/index.html#id235800.

Determine How Much Money Should Be Invested

The first step in investing is to decide how much income you would like to put aside. You can put aside as little as 5 % or as much as 100 % of your total income. Your goals will determine the amount you allocate.

It may not be a good idea to put too much money into investments if your goal is to save enough for retirement. If you plan to retire in five years, 50 percent of your income could be committed to investments.

It is crucial to remember that the amount you invest will impact your returns. So, before deciding what percentage of your income to devote to investments, think carefully about your long-term financial plans.